Car insurance serves as a cornerstone of financial protection and legal compliance for drivers worldwide. Beyond its fundamental role in safeguarding vehicles, car insurance provides peace of mind and security for motorists facing unforeseen circumstances on the road. In this comprehensive guide, we delve into the intricacies of car insurance, exploring its types, factors affecting premiums, industry trends, and tips for optimizing coverage.

Understanding Car Insurance

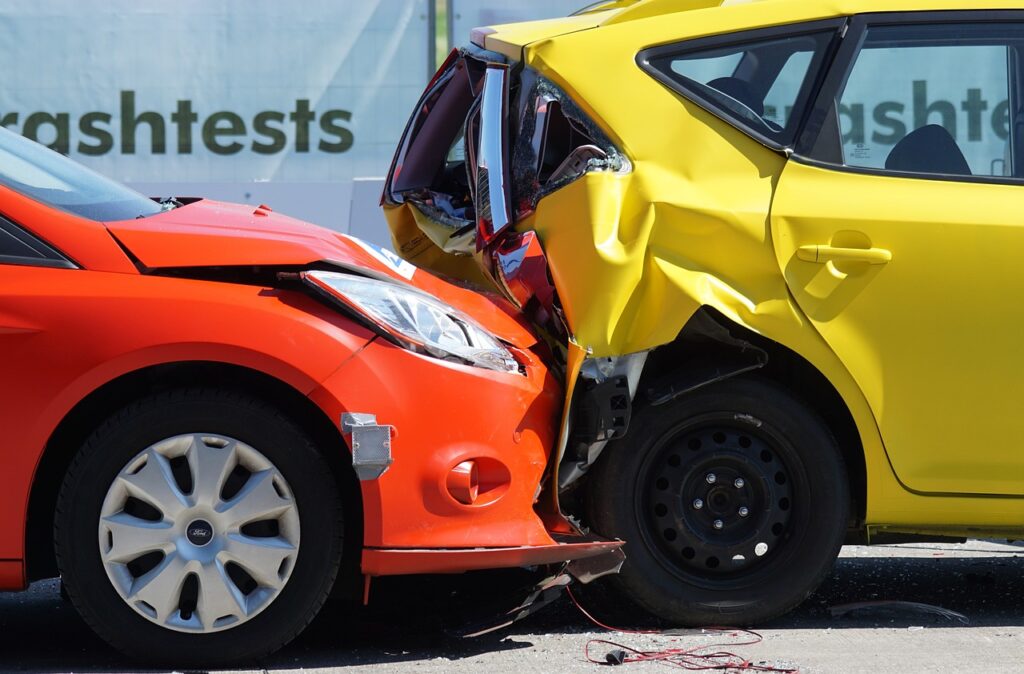

Car insurance encompasses various coverage types, each tailored to address different aspects of potential risks and liabilities. Liability insurance, a mandatory requirement in most jurisdictions, covers damages to third parties resulting from accidents where the insured driver is at fault. It includes bodily injury liability and property damage liability components, ensuring financial protection against medical expenses, legal fees, and property repair costs.

Comprehensive and collision coverage offers protection for the insured vehicle itself. Comprehensive coverage safeguards against non-collision incidents such as theft, vandalism, fire, or natural disasters, while collision coverage reimburses repair or replacement expenses resulting from collisions with other vehicles or objects.

Additionally, uninsured/underinsured motorist coverage shields policyholders from financial losses caused by drivers lacking adequate insurance coverage. Personal injury protection (PIP) or medical payments coverage caters to medical expenses for the insured driver and passengers, irrespective of fault.

Factors Influencing Car Insurance Premiums

Car insurance premiums are determined by various factors, including:

- Driving History: A clean driving record typically qualifies for lower premiums, while traffic violations, accidents, or DUI convictions may lead to higher rates.

- Vehicle Type: The make, model, age, and safety features of the insured vehicle significantly impact insurance premiums. Sports cars and luxury vehicles generally incur higher premiums due to increased risks and repair costs.

- Location: Geographic factors such as urban density, crime rates, and weather patterns influence insurance premiums. Drivers residing in high-traffic urban areas or regions prone to severe weather may face higher premiums.

- Age and Gender: Younger, inexperienced drivers and males statistically pose higher risks, resulting in elevated insurance premiums compared to older, more seasoned drivers and females.

- Credit Score: In some jurisdictions, credit history plays a role in determining insurance premiums. Policyholders with lower credit scores may face higher rates due to perceived financial risk.

- Coverage Limits and Deductibles: Opting for higher coverage limits and lower deductibles typically translates to higher premiums, while choosing lower coverage limits and higher deductibles can reduce premium costs.

Industry Trends and Innovations

The car insurance industry continues to evolve, driven by technological advancements, consumer demands, and regulatory changes. Key trends and innovations shaping the industry include:

- Usage-Based Insurance (UBI): UBI programs leverage telematics technology to monitor driving behavior, allowing insurers to customize premiums based on actual driving habits rather than generalized risk assessments.

- Artificial Intelligence (AI) and Predictive Analytics: Insurers utilize AI algorithms and predictive analytics to assess risk profiles more accurately, streamline claims processing, and detect fraudulent activities.

- On-Demand Insurance: With the rise of ride-sharing services and flexible transportation models, insurers are exploring on-demand insurance solutions that offer coverage tailored to specific usage periods or mileage increments.

- Blockchain Technology: Blockchain platforms enhance data security, transparency, and efficiency in insurance operations, facilitating seamless policy management, claims settlement, and fraud prevention.

- Environmental Sustainability: Some insurers promote eco-friendly initiatives by offering incentives or discounts for hybrid or electric vehicle owners, encouraging environmentally responsible driving practices.

Tips for Optimizing Car Insurance Coverage

To maximize the value of car insurance coverage and minimize costs, consider the following tips:

- Shop Around: Compare quotes from multiple insurers to find competitive rates and coverage options tailored to your needs.

- Bundle Policies: Bundling car insurance with other policies such as homeowners or renters insurance often qualifies for discounts.

- Maintain a Clean Driving Record: Safe driving habits not only reduce the risk of accidents but also contribute to lower insurance premiums over time.

- Review Coverage Regularly: Periodically reassess your insurance needs and coverage limits to ensure adequate protection without overpaying for unnecessary features.

- Take Advantage of Discounts: Inquire about available discounts for safe driving, anti-theft devices, multi-vehicle policies, and loyalty programs to lower premium costs.

- Consider Higher Deductibles: Increasing deductibles can lower premiums, but ensure you can afford the out-of-pocket expenses in the event of a claim.